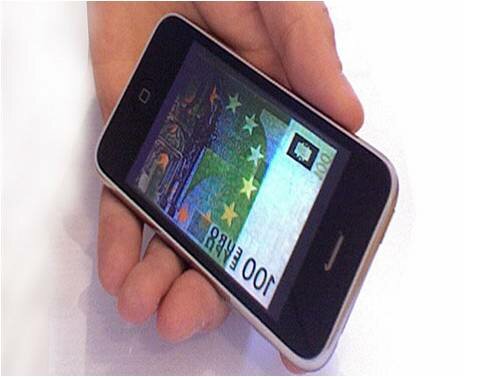

Why mobile payments will be a success in 2011…

January 26, 2011 14:11 by Ryan GarnerMany mobile companies and big brands are ready to launch mobile payment services this year. Although there is a healthy amount of consumer scepticism, there is also enough interest among early adopters and smartphone users to make this a success.

Last month TechTalk published a post about NFC (Near Field Communication) based mobile services becoming adopted among a wider consumer base in 2011. At the time of publishing we highlighted a number of new services and advances being made, from small start-ups to smartphone giants such as Apple, Google and Nokia. Now we’re almost one month into 2011 the news and developments on NFC, in particular mobile payments, continues to hit the headlines in the technology press. Most notably, O2[1] is beefing up their m-payments team ahead of its NFC based mobile payments service launch later this year, whilst Google announced the launch of Android 2.3 OS (Gingerbread)[2], which adds support for NFC.

With all the supply side movements, one thing that isn’t fully understood is the likelihood that consumers will adopt NFC based technologies, especially those relating to the transfer of money. I recently came across a research paper[3] which contended that the majority (59%) of French consumers were against the idea of mobile payments. Whilst this negative majority shouldn’t be discounted, the 41% in favour suggests to me that there are enough consumers in the French market interested enough to make this a viable business opportunity. Indeed, this amount of scepticism is somewhat inevitable when new ways of managing personal finance are introduced. I’m sure if we wound the clock back ten years and asked the same question about buying products online we would see similar levels of concern.

However, since smartphones have proliferated and mobile apps have made the way we access online content infinitely easier, consumers are more comfortable using their phones in day-to-day lives. With smartphone sales showing no sign of abating and the devices becoming cheaper (especially those using Android OS) mobile payment based services are likely to be a very lucrative market in the future. To assess how comfortable consumers are using their mobile phone to pay for products in store a recent study by GfK NOP[4] benchmarked mobile payments with other smartphone behaviours. The research focussed on behaviours that require the transfer of data over the air (OTA) or via contactless transfer.

If we take the sharing of content as a proxy for the mobile behaviour consumers would be most comfortable with, then mobile payments are not far behind: Using a 10 point scale, 23% of UK adults feel very comfortable (top 3 points) sharing content using their phone, whilst in contrast, 17% of UK adults would be very comfortable using their mobile to pay for products in store, a very narrow gap with sharing content. Inevitably, those with smartphones who are used to using apps and mobile services are more comfortable adopting mobile payments based services and are thus the prime target for NFC based services.

The key to success and significant consumer adoption will rest on two key factors coming good this year; simplicity of the user experience and trust in the vendor.

Simplicity

Simplicity is absolutely crucial because let’s face it, paying for products in store with cash or card is no arduous task, so mobile payments need to be at least as simple as current convention. Last month I realised just how important this was when I was discussing mobile payment business models with a business associate living and working in Bangalore, India. I knew mobile payments were big in India but I was completely taken aback when I was told how simple the process was. To send a payment from one person to another required sending an SMS with the recipient’s mobile number, the amount to be transferred and the senders PIN. Simple as that. Obviously, the financial infrastructure in India is less developed than European and US models, and this in part has accelerated development of mobile payments in India due to the scale mobile phones provide. However, without the simplicity in the user experience this change in behaviour would not have come about so quickly nor would it have been so widely adopted.

Trust

As for trust, service providers in western markets have a higher level of red-tape and regulations to work around, which offers some assurance to consumers. Although the two aforementioned brands O2 and Google are not traditional financial companies, they have financial products in O2 Money and Google Checkout. Brands which, like Starbucks, want to introduce mobile payments in their stores can harness their own brand equity whilst leveraging the trust in established financial vendors – Visa, Mastercard and increasingly Paypal to support the transfer of money.

The prospect of mobile payments has been around for years so what makes 2011 any different? It’s the impact of the smartphone has had over the past four years. They not only help simplify the user experience (through apps) but they have also changed the way we use mobile phones. This helps consumers feel more comfortable combining personal finance with their trusty pocket companion, the mobile phone.

[1] Source: ZDNet http://www.zdnet.co.uk/blogs/communication-breakdown-10000030/o2-to-boost-mobile-payments-team-ahead-of-nfc-launch-10021454/

[2] Source: GSMA Mobile Apps Briefing http://www.mobilebusinessbriefing.com/apps/article/report-first-nfc-apps-available-for-android

[3] Source: Near Field Communications World http://www.nearfieldcommunicationsworld.com/2011/01/20/35692/most-french-consumers-not-in-favour-of-mobile-payments/

[4] Conducted in December 2009 among a representative sample of UK adults who have access to the internet (base = 773)

PHOTO COURTESY OF FLICKR USER:

http://www.flickr.com/photos/montymetzger/

Related posts:

Tags: Android, Apple, Contactless Payments, iPhone 5, Mobile Pay App, Mobile Payments, Mobile Wallet, Near Field Communication, Network Operators, NFC, Nokia, O2, Smartphones, User Experience, UX

[...] [7]https://gfktechtalk.com/2010/11/22/will-2011-be-the-year-nfc-finally-takes-off/ https://gfktechtalk.com/2011/01/26/why-mobile-payments-will-be-a-success-with-consumers-in-2011/ [...]